Tailored Coverage Plans for Your Unique Needs

We highlight our commitment to tailoring insurance plans that perfectly suit your individual requirements. Our expert agents work closely with you to create a coverage plan that considers your specific needs and budget, ensuring you receive the most suitable protection.

Not all plans are available in your area. Call and speak with an Agent and find out what works best for you.

About G2 | Agency

Your Trusted Life, Accident and Health Partner

G2 | Agency strength is its mission: to provide insurance and retirement solutions to help people live longer, healthier lives. We’re a national leader in developing, marketing, distributing and administering life and health insurance, annuities, and retirement planning solutions to enhance the lives of pre-retirees and retirees.

Products with Your Total Financial Wellness In Mind

G2 | Agency a wealth of financial solutions from leading carriers to fit every budget. Solutions are customized for your needs and easy to obtain — from application to policy issue to leveraging their benefits when you need them most.

Medicare Supplement Insurance Plans

Learn your Medicare Supplement ABCs

There are 10 Medicare Supplement plan types. Letters of the alphabet identify the various plans, and each plan represents a particular level of coverage.

Here is something you probably did not know: cost is all that separates one company’s Medicare Supplement line from another company’s. The plan details and policy benefits are identical, no matter which insurer carries the product. That is an important fact to keep in mind.

It is no wonder people are confused about Medicare. It is a complex program and a challenge to decode.

G2 | Agency wants to help ensure you understand each of the available plans.

Final Expense (Burial) Insurance

We specialize in helping individuals like you find affordable final expense life insurance to cover funeral expenses, cremation costs, and any other end-of-life needs.

What You'll Receive

Guaranteed acceptance 45-85

Coverage: $2,000–$25,000

Benefits that are never reduced because of age or health

No medical exams or health questions to answer

Affordable rates that never increase

Long-Term Care Coverage

Similar to short-term care, long-term care or LTC

provides a broad and longer range of care for daily

living, and often pays for services not covered by

Medicare or traditional health insurance.

Short-Term Care Coverage

Short-term care coverage typically covers home care, assisted living, and nursing home care for up to 12 months.

Term Life Insurance

The most affordable form of life insurance, term life

insurance provides coverage for a specific period of

time. Unlike whole life insurance, term life insurance

does not build cash value or pay a death benefit once

the policy term has expired.

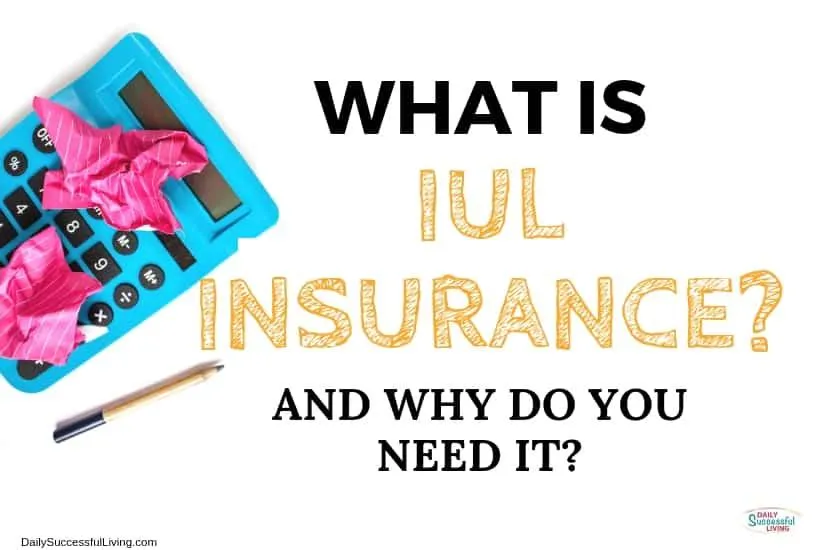

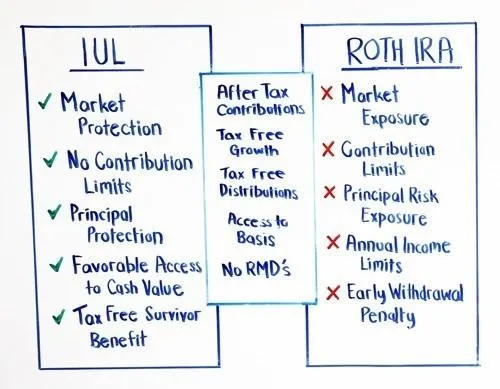

Indexed Universal Life - It's not grandmas life insurance!

Indexed Universal Life (IUL): The Swiss Army Knife of Life Insurance. An Indexed Universal Life (IUL) policy is incredibly versatile, offering much more than traditional life insurance. It's designed to be customized to meet various financial goals, including retirement planning. With an IUL, the cash value is allocated to a secure investment, such as an Index Fund. This means you benefit from the growth potential of premium index accounts, while still enjoying the security of cash value insurance.

Think of an IUL as a hybrid between a retirement plan and a life insurance policy. It allows you to participate in stock market gains without the risk of losing money.

What is an annuity?

Annuities are often guaranteed income insurance products. Here’s how they work: You purchase an annuity contract through a broker or advisor and contribute to it based on the terms of the agreement. The insurance company then invests the annuity contributions in various market instruments—like mutual funds. Depending on the terms of the contract, annuities then convert contributions to a series of payments that you’ll receive at a future date. In essence, it’s an insurance contract in which buyers pay into today but receive a benefit in the future.

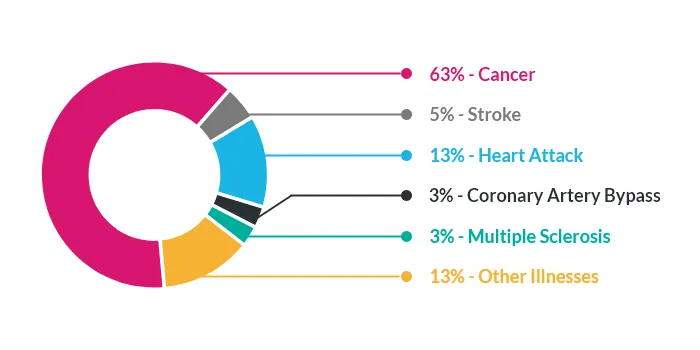

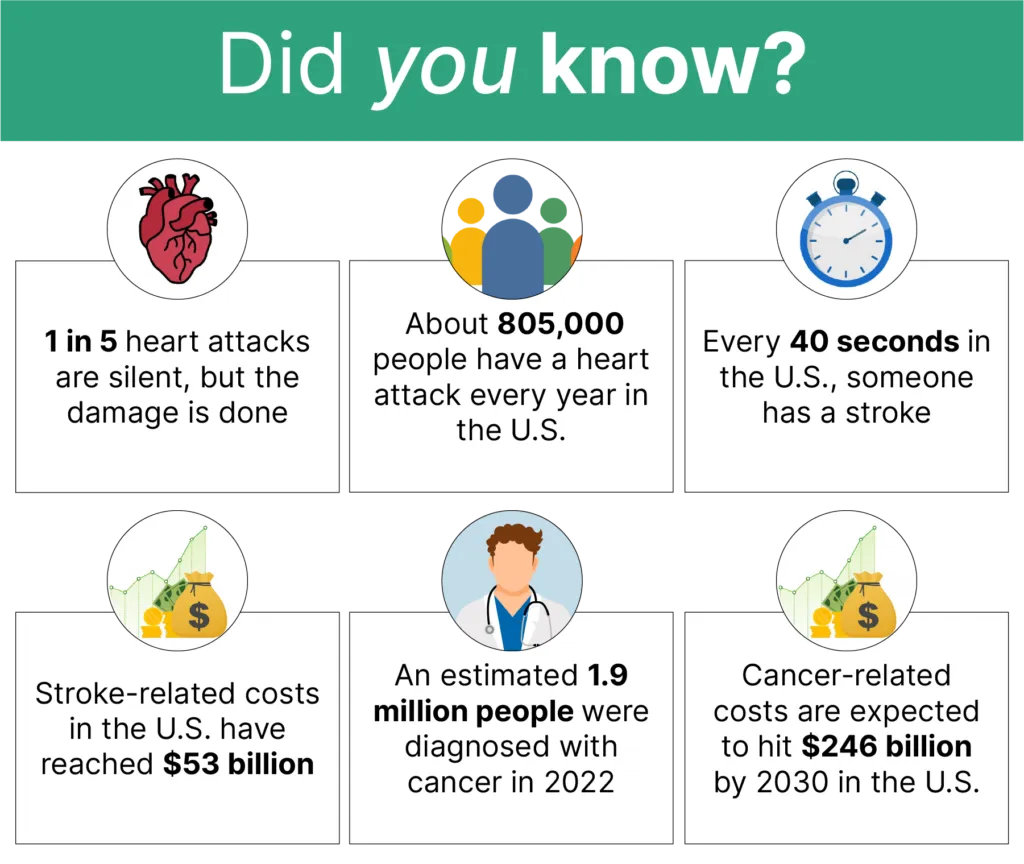

Cancer insurance can help you focus on what’s most important... getting well

Cancer-Critical Illness Insurance provides a financial safety net in the event of a severe diagnosis, such as cancer, heart attack, or stroke. It offers a lump-sum benefit upon diagnosis, helping to cover medical expenses not included in traditional health insurance, such as deductibles, copays, and out-of-pocket costs for treatments. Additionally, it can help with non-medical expenses like mortgage payments, transportation, or household bills, allowing you to focus on recovery rather than financial strain. This coverage ensures that you and your family have added protection during one of life's most challenging times.

TESTIMONIALS

CUSTOMER REVIEWS

I recently turned 65 and chose AmeriLife for my Medicare Advantage plan. The experience was excellent—everything was straightforward, and the customer service was top-notch. I feel confident and well-covered with my new plan.

Audrey Kane

As the executor of my parents' estate, I had the responsibility of securing burial insurance. Todd and the team at AmeriLife made this difficult task much easier with their professionalism and compassion. Their guidance and support were invaluable, and I am grateful for their exceptional service.

Trevor Gravink

G2 | Agency ©2025

Not affiliated with the U. S. government or federal Medicare program.

We do not offer every plan available in your area. Any information we provide

is limited to those plans we do offer in your area.

Please contact

to get information on all of your options.